IA Fintech Member Insights: Finreg-E

Case Study: Finreg-E delivers 60% reduction in costs and 100% reduction in risks at a UK Bank

Overview

Our client, the Chief Compliance Officer of a mid-tiered UK retail and investment bank wanted proof that RegTech can actually work in reducing her risks, the level of human capital employed and increasing the efficiency and accuracy in her bank’s regulatory horizon scanning and capture process.

Finreg-E stepped up to the challenge to deliver her the proof!

We showed our COO the savings Finreg-E can deliver on the human capital employed and operating costs over a period of one month by replacing the Bank’s manual regulatory change management processes with Finreg-E’s intelligent AI automated compliance solutions.

The result: A saving of over 60% in costs and a 100% reduction in risks in managing regulatory changes! Finreg-E is proof that RegTech delivered with the right domain knowledge and experience can significantly reduce the risks and costs associated with managing regulatory compliance.

Our Challenge: Why choose a £7,000 software license fee for regulatory scanning versus £64,000 per month manual process performed by my staff?

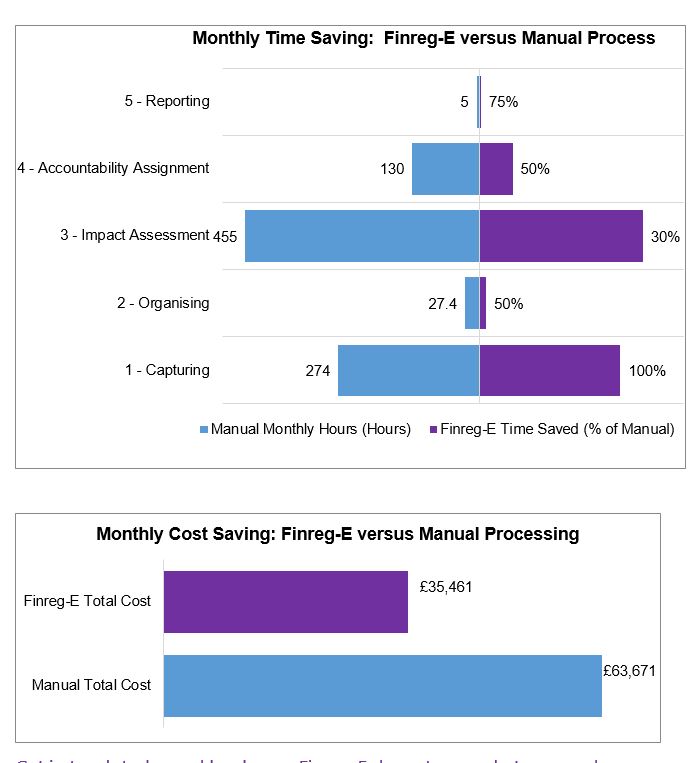

Before Finreg-E, the Bank’s regulatory horizon scanning was performed on a fully manual, spreadsheet-based process via the following five typical steps:

- Capturing: A siloed horizon scanning and recording process performed individually by 5 FTEs across risk, finance, compliance, HR and legal teams, costing £20k/month for each of them to scan regulator websites, emails and RSS feeds to capture changes in a spreadsheet;

- Organising: 28 monthly hours spent in meetings and conversations to organise their collectively captured data and consolidate into a single regulatory change data spreadsheet;

- Initial Impact Analysis: a staggering 455 hours spent per month, on average, analysing the impact of changes and relevance to the Bank’s business;

- Accountability Assignment: 325 emails exchanged monthly to identify the right business units and SMEs accountable for the regulatory changes;

- Reporting: 5 hours per month spent on preparing management information to inform the Board and governance relevant committees on the Bank’s evolving regulatory change landscape;

The full process costing the Bank a staggering £64,000 per month.

The Solution: Finreg-E’s intelligent real-time regulatory monitoring and impact analysis solutions for only 10% of your monthly manual costs

To provide proof that AI and machine learning can actually work to manage regulatory compliance, Finreg-E delivered its intelligent real-time horizon scanning and impact analysis solutions to replace the 5 key processes the Bank was performing.

The result: Finreg-E reduced the Bank’s monthly costs by over 60%, eliminated its risks by over 100% in missing a new relevant regulatory development, provided a single platform across users and removed the mess of maintaining change data across numerous spreadsheets, PowerPoints and emails.

Our solutions deployed were:

- Capturing: Finreg-E’s Regulatory Change Viewer that delivered regulatory changes across multiple regulators in real-time, removing the need to manually scrape regulatory websites to capture change data;

- Organising: Our Regulatory Change Viewer delivered changes in an organised and harmonised format across regulators so the data is ready to be worked in a standardised format across users and SMEs;

- Initial Impact Analysis: Finreg-E’s global rule topic and internal compliance standards mapping analysis instantly identified relevant regulatory topics and impacted internal compliance policies and standards, to provide a result on which rule changes impact the Bank, how they impact and what needs to be done;

- Accountability Assignment: Finreg-E’s audit, tagging and workflow capabilities flagged owners of mapped compliance standards to regulatory changes, so that changes are assigned in an informed way to the right owners in first go, and an audit trial of what’s happening with the changes is maintained;

- Reporting: Finreg-E’s customisable compliance dashboards to create management information with a click of a button from chosen data and attributes.

The Results: 60% saving on time and costs, 100% reduction risks of missing a relevant regulatory update

- Capturing: £20,000 saved monthly on identifying changes – that’s 100% saving versus the Bank’s manual process;

- Organising: Change data is organised and delivered in half the time versus the manual process;

- Initial Impact Analysis: A 30% saving in time, and a > 50% increase in speed and accuracy of interpreting the impact of new regulatory changes;

- Accountability Assignment: > 100% accuracy in identifying the right SME’s accountable for new changes versus the manual information gathering process;

- Reporting: Readily available dashboards in one hour at a click of button versus five hours of manual work in generating a pretty PowerPoints.

Get in touch today and book your Finreg-E demo to see what we can do for you

We recognise that managing and maintaining regulatory compliance is one of the most time and resource consuming activity. We would welcome sharing with you how we are helping our clients harness the power of automation to solve their compliance problems.

Visit us at www.finreg-e.com to book your Finreg-E demo today and let us share our knowledge and experience to help you make your regulatory compliance management more automated, accurate and efficient.